WOO raises $9M from market makers to further improve WOO X liquidity

The strategic round helps to further align market makers and support WOO X in becoming the leading institutional-grade trading platform

January 18, 2024 - WOO announced the completion of a $9 million funding round exclusively from current and future designated market makers (DMMs) on WOO X. The primary purpose of the strategic raise is to further align market makers with WOO as they help to improve the liquidity on WOO X. The participants of the strategic raise include Wintermute, Selini Capital, Time Research, Presto Labs, Pulsar, AlphaLab Capital, Efficient Frontier, Amber and Riverside Hedge.

“We are thrilled to share the expanded relationship of market makers on WOO X, following the launch of our DMM program in August last year. Notably, these leading market makers have collectively contributed $9 million in funding, underscoring their confidence in our platform. We anticipate liquidity on WOO X to improve substantially in the next few months, starting with BTC and ETH perpetual futures markets and expanding into altcoin perpetual futures and all spot markets,” said WOO Co-founder Jack Tan.

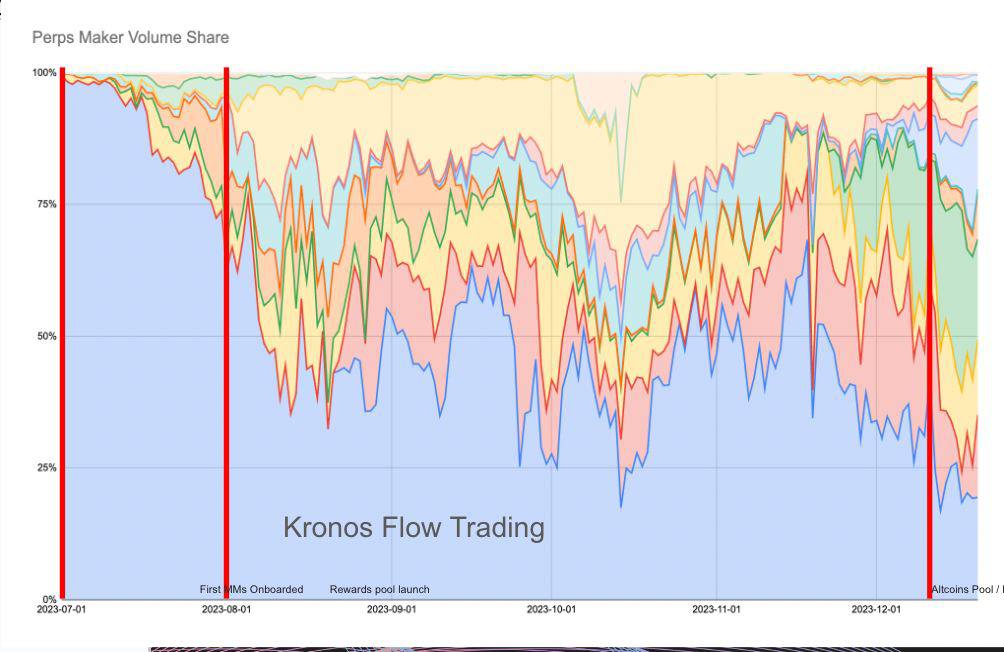

In Q3 last year, WOO X revamped its business model to move away from a single liquidity provider, Kronos Research, to an ecosystem of liquidity providers for spot and perpetual futures markets. Some notable actions include updating its fee structure, enhancing its technology infrastructure to support many DMMs quoting simultaneously, introducing a maker rebate in USDT, and launching a DMM rewards pool to further incentivize DMMs to provide liquidity on WOO X.

Additionally, WOO will continue to improve its business model by launching a DMM program for its spot markets in Q1 2024. Collectively, these initiatives will enable WOO X to achieve a 100% custody ratio by Q2 of this year. This will result in eliminating the clause within WOO X’s Terms of Service that permits lending of clients’ assets to market makers, which has been a major request from WOO’s community.

Tan said the funds will primarily be used for global market expansion, reinvesting into improving its product suite, obtaining regulatory licenses in key markets, and aggressively marketing to grow its market share across CeFi. He emphasized that the primary purpose of the initiative was to align interests of liquidity providers, rather than raise capital, given the total amount is less than a quarter of its Series A, and noted it was exclusively participated by market makers that will contribute to improving liquidity on WOO X rather than traditional venture capital funds.

"We are pleased to further our collaboration with WOO as it leverages our expertise in providing robust liquidity. Having built up trust with the WOO team over the latter part of 2023, we now believe they exhibit the potential to expand growth and cement a top-tier position as an exchange,” Evgeny Gaevoy, CEO and co-founder of Wintermute said in a statement.

“This partnership with WOO aligns with our goal of providing liquidity at top-tier trading platforms while contributing to the growing adoption of virtual assets in Asia. We share a similar mission of meeting the diverse needs of users, building innovative technology, and maintaining regulatory compliance to foster trust and reliability within the thriving virtual asset ecosystem,” Yongjin Kim, Co-Founder of Presto Labs said in a separate statement sent to WOO.

For his part, Jordi Alexander, CIO of Selini Capital said, "We are excited to be investing into deepening our partnership with WOO, one of the rapidly ascending platforms that is staying ahead of the curve. We look forward to applying our trading expertise to helping the team further refine their exchange as they also enter the sizable spot markets.”

--

The content above is neither a recommendation for investment and trading strategies nor an offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.