Social trading risk management: A guide to sustainable performance

Copy Trading—also known as Social Trading on WOO X—carries unique risks that every trader should understand. This educational piece explores how to optimize your strategy portfolio, helping you avoid common pitfalls and succeed in selecting the best Lead Traders on the platform.

Common mistakes in copy trading and what to avoid

It's easy to be drawn to a Lead Trader boasting an exceptionally high ROI and consider investing heavily. However, committing without thoroughly assessing the associated risks can lead to poor decisions. Remember, a high ROI may not provide the complete picture; market conditions can change, and it's crucial to ensure that the Lead Trader’s strategy aligns with your risk tolerance and long-term goals.

Before we delve into the specifics of selecting the right Lead Trader, let's first examine the common pitfalls to avoid when starting in Social Trading:

What about WOO Shield?

As explained, Lead Traders often have their own ideas on the risk/reward ratio and the execution time frames of their own trading strategy.

However, the reality is that not all Copiers share the same risk profile. This is where WOO Shield comes in.

WOO Shield enables you to adjust your desired total stop loss and slippage tolerance settings to optimize your trade execution, as well as the total loss that you’re willing to accept.

Total Stop Loss:

Closes all your copied positions and stops copying the Lead Trader once you lose a certain percentage of funds.

When to use it?

- When you wish to minimize risks when copying a Lead Trader who has a high recent ROI% but may potentially perform badly if the market reverses direction

- When the Lead Trader has a high max drawdown

- When you wish to protect your funds for future diversification into other Lead Trader strategies

Slippage Tolerance:

By default, Copiers will use market orders to open new positions. This means that Copiers may experience a slightly worse average price execution as compared to the Lead Trader’s average entry price. Use this setting to enforce Immediate or Cancel (IOC) orders and optimize your trade execution.

When to use it?

- Lead Trader tend to open positions on less liquid altcoins

- Lead Trader has a lot of active Copiers, or high amount of total Copier assets

Based on the data gathered on the platform, less than 8% of all Copiers are currently using WOO Shield. 91% of Copiers don't have total stop loss enabled.

Choosing your first Lead Trader

Ready to jump into the exciting part?

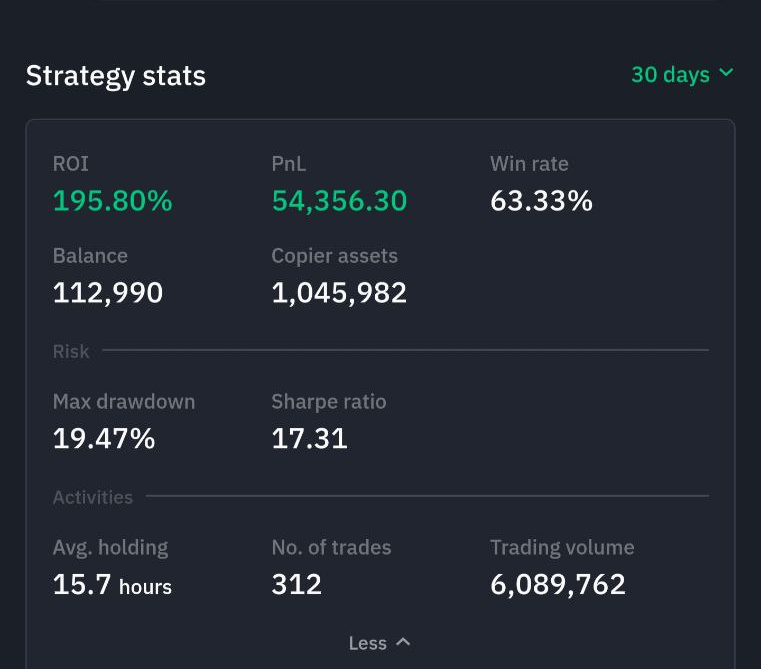

Let’s talk about selecting the right Lead Traders. On WOO X, Lead Traders are ranked based on key performance indicators like ROI% and Sharpe ratio. While it’s easy to just copy the trader with the highest ROI or PnL, that approach alone won’t guarantee success.

It’s crucial to also consider factors like win rate and max drawdown. A trader with high ROI might have simply benefited from favorable market conditions, but their gains could vanish in volatile markets. What you want is a Lead Trader with a high win rate and low max drawdown—this signals strong risk management and a strategy that can withstand market fluctuations.

The Sharpe ratio is another essential metric to assess whether the Lead Trader is genuinely outperforming the market or just riding the wave. A high Sharpe ratio means they’re generating better returns for every unit of risk they take.

Don’t forget to look at the performance of active Copiers for that Lead Trader. Are they consistently profitable? How long have they been copying? If long-term Copiers are seeing steady gains, that’s a good sign.

For the more curious minds, you can dig deeper by checking the Lead Trader’s current open positions or even visiting their social media profiles to get a better grasp of their strategy. Doing your homework here could be the difference between following a flash-in-the-pan success or a seasoned pro.

- Examples of good risk-adjusted LTs

Let’s consider the above Lead Trader as a prime example. While he did not hold the title of top Lead Trader by ROI% (at the time of writing), his impressive 30-day win rate of 63.3% and a maximum drawdown of just 19.47% showcase his strong performance.

In addition to a high Sharpe ratio, these metrics indicate that his strategy consistently outperforms the market while effectively managing risk.

Keep in mind that Lead Trader performance is subject to change at any time, so it’s crucial to evaluate them based on their most recent results.

Final points

Successful Social Trading on WOO X requires a thoughtful approach that includes continuous learning, strategic alignment, and effective risk management. By leveraging tools like WOO Shield, diversifying your investments, and actively engaging with your chosen Lead Traders, you can enhance your trading performance and navigate the complexities of the market. Stay informed, evaluate your strategies regularly, and take the necessary steps to ensure your trading journey is both rewarding and sustainable.

Disclaimer

The information provided in this article is for educational and general information purposes only and does not in any way constitute legal, financial or investment advice, or professional advice of any kind. We strongly recommend that you seek independent advice from a qualified professional before making any investment or financial decisions related to cryptocurrencies. While every effort has been made to ensure the accuracy of the information contained herein, WOO X and its affiliates make no representations or warranties, express or implied, as to the completeness, accuracy, or reliability of the content. We shall in NO case be liable for any loss or damage arising directly or indirectly from the use of or reliance on the information contained in this article.

Social Trading, including Copy Trading, and any cryptocurrency-related transactions involve significant risk. The past performance of Lead Traders is not indicative of future results. You should not engage in Social Trading or rely on the performance metrics of Lead Traders without independently assessing your own risk tolerance, investment goals, and market conditions. It is advised that you carefully consider whether the trading strategies presented are suitable for your circumstances before participating in any trading activity on the WOO X platform.

The tools, strategies, and examples provided, including WOO Shield and any referenced Lead Traders, are subject to market risks and may not guarantee favorable outcomes. Users are solely responsible for their trading decisions, and WOO X disclaims any liability for potential losses incurred by following or copying a Lead Trader.

You should seek independent financial advice if you are unsure about your investment strategies or risk management approach. By participating in Social Trading on WOO X, you acknowledge and accept the risks associated with trading and the potential for financial loss.